maine excise tax exemption

The amount of the exemption is currently 10000. 100-disabled Veterans are Exempt from one Vehicle Excise Tax Title Fee and Drivers License Renewal Fee.

AIRCRAFT HOUSE TRAILERS AND MOTOR VEHICLES.

. Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax. 692021 - PASSED TO BE ENACTED. All boat owners who have boats registered in a state other than the State of Maine as well as owners of Federal Documented boats are subject to pay a State of Maine Excise Tax to the Excise Tax Collector of the Town where the boat is moored docked located.

LD 1193 HP 871 An Act To Exempt Certain Disabled Veterans from the Motor Vehicle Excise Tax. Veterans Excise Tax Exemption. 2020 - 2022 Tax Alerts.

Home of Record legal address claimed for tax purposes. To apply for this exemption the resident must present to the municipal excise tax collector certification from the commander of the residents post station or base or from the commanders designated agent that the resident is permanently stationed at that post station. The Maine Legislature passed a bill that gives 100-disabled veterans exemption from excise tax on one registered vehicle.

Excise Tax is defined by State Statute as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways. Veterans exemption - this exemption is granted to the veteran who has served in an organized war period and has reached the age of 62. Is a lifeboat or raft carried by another vessel.

36 MRSA 1483 sub-12 as amended by PL 2009 c. Be it enacted by the People of the State of Maine as follows. Adult Use Marijuana Licensing Ordinance.

This individual is permanently assigned to the unit and station identified above is on active duty and is not a member of the Guard or Reserves. Maine Department of Inland Fisheries and Wildlife 353 Water Street 41 SHS Augusta ME 04333 Phone 207-287-8000 Fax 207-287-9037. An opportunity for businesses with solar energy systems.

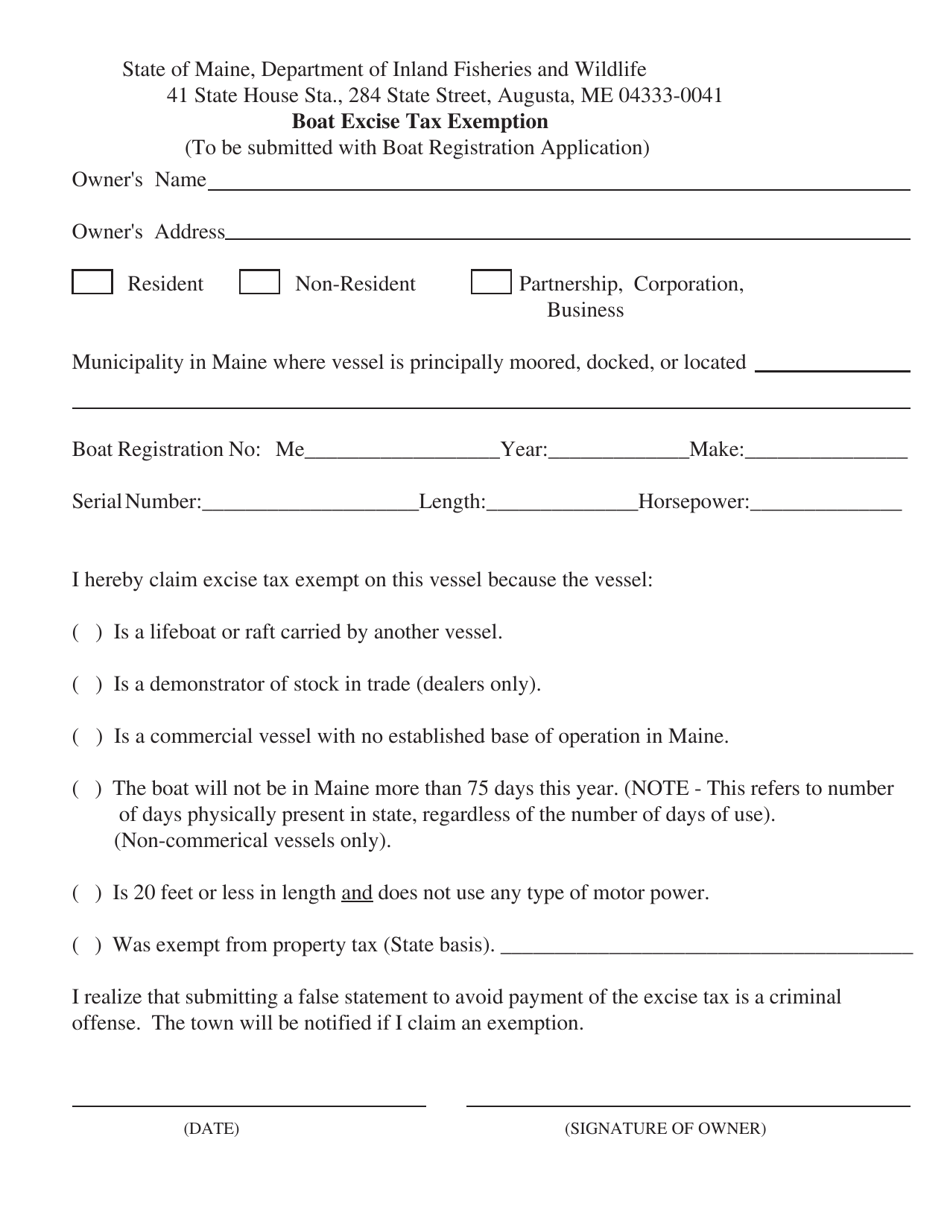

To qualify for this exemption the resident must present to the municipal excise tax collector certification from the commander of the residents post station or base or from the commanders designated agent that the resident is permanently stationed at that post station or base or is. I hereby claim excise tax exempt on this vessel because the vessel. March 9 2022 News.

An Act To Exempt Certain Disabled Veterans from the Motor Vehicle Excise Tax. Maine LD 1430. MAINE REVENUE SERVICES SALESEXCISE TAX DIVISION AFFIDAVIT OF EXEMPTION For purchases of electricity fuel or depreciable machinery or equipment for use in commercial agricultural production commercial fishing commercial aquacultural production or commercial wood harvesting pursuant to Section 2013 of the Maine Sales and Use Tax Law.

Vehicle Registration Fee - 100 permanent and total service-connected disabled veterans exempt from one registration fee title fee and driver license renewal fee. Sponsored by Representative Heidi Brooks. Homestead Exemption -This program provides a measure of property tax relief for certain individuals that have owned homestead property in Maine for at least 12 months and make the property they occupy on April 1 their permanent residence.

Vehicle Registration Exemptions and Financial Benefits. For these Veterans the Maine Disabled Veterans license plates are exempt from all motor vehicle related fees to include excise tax sales tax registration and title fees for vehicles with a registered weight of 26000 lbs. Automobiles owned by veterans who are granted free registration of those vehicles by the Secretary of State under.

Boat Excise Tax Requirement To Eliot In Lieu of Maine Boat Registration or Federal Documentation. The following are exempt from the excise tax. Property owners would receive an exemption of 25000.

Military Exemption From Vehicle Excise Tax City of Portland is pleased to allow exemptions for annual excise tax on vehicles owned by residents who are serving on active duty in the Armed Forces and who are permanently stationed at a military or naval post station or base outside of the State of Maine or who are deployed for military service for more than 180 days. It modifies the exemption for benevolent and charitable institutions by limiting it to only those vehicles owned by such an institution that are used solely for the institutions purposes and primarily for transporting or delivering goods to persons who have been determined to be eligible to receive. Alternate formats can be requested at 207 626-8475 or via email.

WHERE DO I PAY THE EXCISE TAX. This bill amends the law that allows certain exemptions from the vehicle excise tax. Vehicles owned by this State or by political subdivisions of the State.

To view PDF or Word documents you will need the free document readers. The vehicle must have disabled veteran plates. The owner must have owned homestead property in the State of Maine for a minimum of 12 months.

Maine LD1193 2021-2022 An Act To Exempt Certain Disabled Veterans from the Motor Vehicle Excise Tax. Excise Tax is defined by State Statute as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways. The age requirement is waived if the veteran is designated as 100 disabled under.

In 2019 Maine passed bill LD 1430 which introduces a solar tax exemption for both business and residential owners enabling renewable energy adopters to save moneywhile adding real value to their property and assets. If you need financial counseling or other assistance please click on the map below to connect to all of Maines Legal and. Excise tax is paid at the local town office.

Excise tax imposed pursuant to 36 MRSA. 434 20 is further amended to read. Partially exempt property tax relates to the following categories.

Comprehensive Plan Revised 2005. As our experience in Massachusetts has shown eligible businesses. From the annual excise tax imposed pursuant to 36 MRSA.

For a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax. Shoreland Zoning supplemental application.

What Is Sales Tax A Complete Guide Taxjar

Maine Sales Tax Small Business Guide Truic

These Are The States Whose Residents Pay The Highest Taxes Income Tax Tax Refund Income Tax Return

The Emerging Biobased Economy Auri

Original Registration Of Vehicles Taxable Exempt Maine Gov

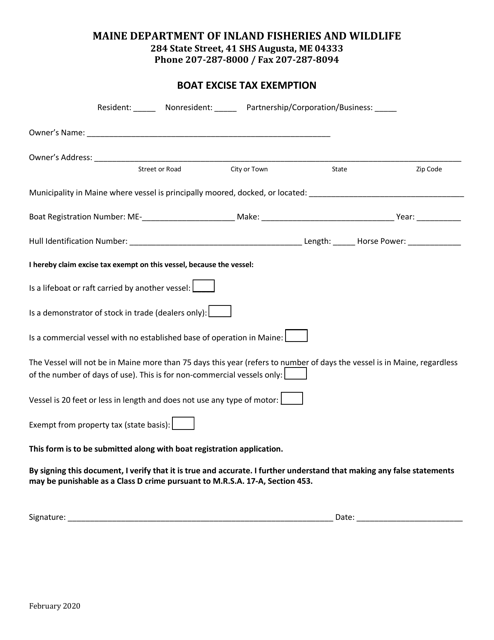

Maine Boat Excise Tax Exemption Download Printable Pdf Templateroller

Maine Sales Tax On Cars Everything You Need To Know

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Maine Reaches Tax Fairness Milestone Itep

Maine Vehicle Sales Tax Fees Calculator

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Maine S Governor Proposes To Replace The Income Tax With A Broader Sales Tax Tax Foundation

M K Gandhi Early Life Freedam Struggle Gandhi Quotes On Education Gandhi Life Gandhi Irwin Pact

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Maine Boat Excise Tax Exemption Download Fillable Pdf Templateroller